HISTORY

Deeply Invested Relationships

Feeling that the major stock companies represented by the agency were not responding to the needs of the independent agency world, Tom Chase of Insurors of Texas formed a property and casualty insurance company. Launched in 1983, Insurors Indemnity Companies differentiated itself by offering insurance products to fit the customers served by our independent agents in a fast and friendly manner. Responsiveness, innovation and common sense underwriting are part of a tradition Insurors Indemnity Companies is proud to carry forward to our next generation of customers.

Company is founded

Early History

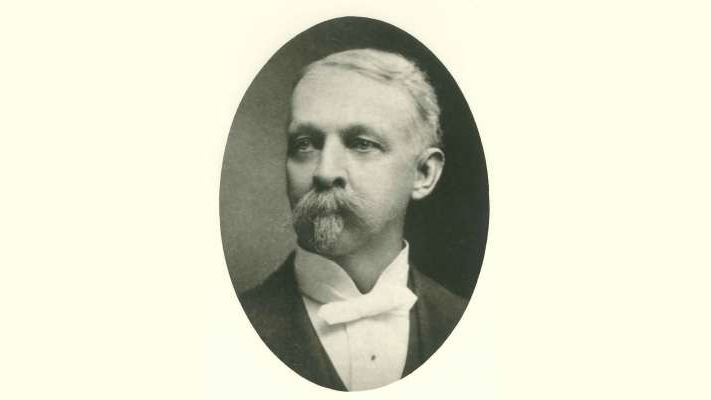

The history of the Insurors Indemnity Companies can be traced back to the late 1890s when John Francis Marshall established an insurance agency in Waco. Shortly thereafter, John sold the company to his brother, E.W. Marshall who was an extensive investor in early local businesses. The small, family-owned company that began operation as the E.W. Marshall Company in 1911 has evolved to become the company we know today as the Insurors Indemnity Companies. In 1923, Mr. Stribling became a partner with Mr. Marshall and in 1930 became the sole owner. The Marshall and Stribling families had distinguished histories in Central Texas. E.W. Marshall was an esteemed investor and banker and President of the Independent Insurance Agents of Texas in 1917.

Business grows

1940’s

In the early 1940s, the expansion of the business dictated that Davis Stribling move the firm to larger offices in the Liberty Building, where it operated for the next 16 years. Davis Stribling was the sole owner of the company until his son, Thomas Stribling became a partner in 1947 upon graduation from the Harvard Business School.

Major Tragedy

1950’s

Tragedy struck the city of Waco in 1953 when a deadly tornado killed 111 people and destroyed much of the downtown area. The Stribling Agency insured a large portion of the damaged buildings and offices. In 1954 Davis Stribling died, and Thomas Stribling took over ownership of the agency. Growing the agency rapidly, the Stribling Agency merged with two other well-established firms, Rolla Greig and Company and E.C. Woodward and Company. Together they formed Stribling, Woodward and Greig, or SWG, Inc., as it came to be known, which was the largest agency in Central Texas.

Insurors of Texas

1970’s

In 1972, Davis Stribling’s grandson, Tom Chase, joined the company and subsequently became the President in 1980. SWG, Inc., then acquired Jackson and Barrett, and changed the name of the combined firms to Insurors of Texas. The building size was doubled to accommodate the new employees, and the firm continued to prosper, establishing offices in Temple and Austin shortly thereafter.

1980’s

Formation of Insurors Indemnity Company

Feeling that the major stock companies represented by the agency were not responding to the needs of the independent agency world, the Directors of Insurors of Texas authorized the formation of a property and casualty insurance company in 1983. Insurors Indemnity Company was formed with capital of $300,000 and began limited operations.

1990’s

Surety Operations Begin

Due to its small size and lack of a Best rating growth in written premiums was limited until in 1992 Insurors Indemnity Companies entered the surety business. Capital was increased and in 1996 a treasury listing allowing it to write federal bonds was obtained.

2000’s

P&C Operations Begin

The companies received the first A. M. Best rating in 2003 at B++ (Very Good). In 2001 the company expanded its writings to property and casualty in addition to surety. Jim Piper became President in 2002, building the P&C and Surety operations. In 2006 Insurors purchased and completely renovated a downtown landmark building which had been vacant since 1989. Built originally in 1911 and expanded in 1925, the Waco Drug Company building has been listed on the National Register of Historic Places and has won several historical renovation honors. As much of the historical fabric as possible was retained in its restoration. The companies continued their growth becoming licensed in New Mexico, Oklahoma and Arkansas with over 300 agents appointed. A.M. Best upgraded the companies’ rating to A- (Excellent) in 2008.

2010

Insurors Indemnity Rebranded

On January 1, 2014 in order for the underwriting companies to focus more diligently on their particular business model, the entire agency retail operations were split out of the holding company, and became owned by the producers working there. While Insurors of Texas Agency remains an important agent of the companies, there is no longer an ownership or management relationship between them. In July 2014 Jim Piper turned over the reins of the companies to Dave Talbert, formerly President of Hochheim Prairie Insurance Companies. Under Talbert‘s leadership the companies have implemented a new marketing effort to rebrand the companies, and have grown the company’s P&C operations into several southwestern states.

2020’s

Insurors Indemnity Underwriters

As a managing general underwriter, Insurors Indemnity Underwriters expanded the number of insurance products available through both admitted and non-admitted, affiliated and non-affiliated companies. This expanded the companies offerings across commercial insurance lines and added personal lines products.